Is The 10 Penalty On Early Withdrawal Waived For 2025 - Individuals may avoid the early withdrawal penalty by receiving substantially equal periodic payments made at least annually for a minimum of five years or until. Exceptions to the 10 IRA Early Withdrawal Penalty YouTube, As you are likely aware, early withdrawals from. Traditional, rollover and sep iras share the same early withdrawal rules.

Individuals may avoid the early withdrawal penalty by receiving substantially equal periodic payments made at least annually for a minimum of five years or until.

Chicago Bears Super Bowl Odds 2025. Below are the teams who were given better odds […]

Tnpsc Group 1 Exam Date 2025. Tamil nadu public service commission has started the tnpsc […]

A guide to the 401(k) early withdrawal penalty, While you can’t avoid paying ordinary income taxes on early retirement account withdrawals, there may be ways you could avoid paying the 10% penalty. * generally, the amounts an individual withdraws from.

IRS Form 1099INT Early Withdrawal Penalties on CDs YouTube, New secure 2.0 act 10% penalty exceptions. What is the 401(k) early withdrawal penalty?

Traditional, rollover and sep iras share the same early withdrawal rules. New secure 2.0 act 10% penalty exceptions.

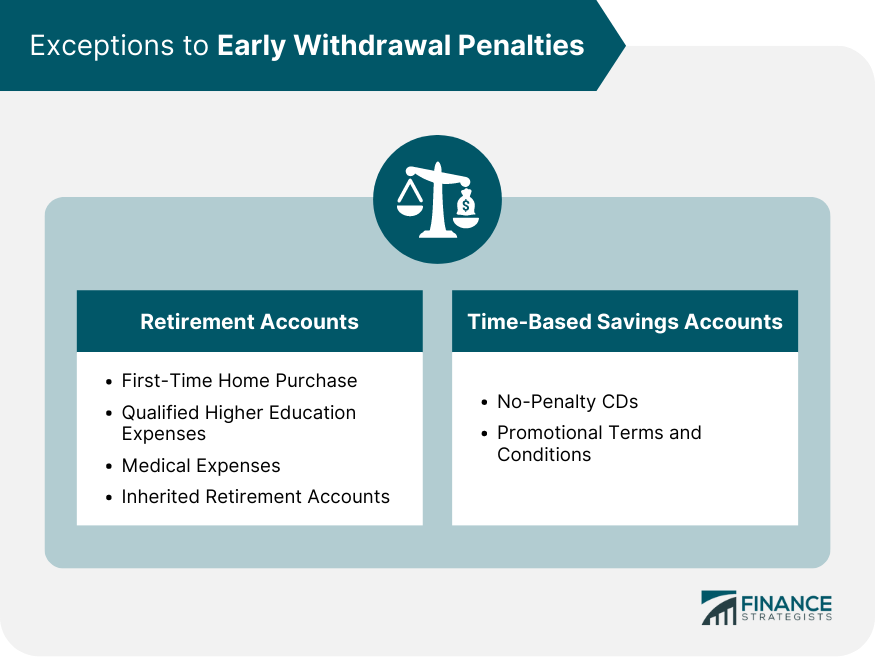

10 IRA Early withdrawal Penalty Exemptions, Since most or all of an early traditional ira withdrawal will probably be taxable, it could push you into a higher marginal federal income tax bracket. While there are tax benefits associated with iras, withdrawing money before age 59 ½ can trigger income taxes and a 10% early withdrawal penalty.

401k Early Withdrawal What to Know Before You Cash Out MintLife Blog, Traditional, rollover and sep iras share the same early withdrawal rules. As you are likely aware, early withdrawals from.

Early IRA Withdrawal Penalty of 10 How Can I Waive the Penalties, While there are tax benefits associated with iras, withdrawing money before age 59 ½ can trigger income taxes and a 10% early withdrawal penalty. The irs has again waived required withdrawals for certain americans who have inherited retirement accounts since 2025.

Exceptions to the IRA EarlyWithdrawal Penalty, If you withdraw money from your 401(k) before you’re 59 ½, the irs usually assesses a 10% tax as an early. Unless one of these 11 exceptions applies, there will be a 10% early withdrawal penalty tax on the taxable portion of a traditional ira withdrawal taken before.

:max_bytes(150000):strip_icc()/exceptions-ira-early-withdrawal-penalty-2388980-Final-38a20015611944799acc47f83bba47af.png)

Since most or all of an early traditional ira withdrawal will probably be taxable, it could push you into a higher marginal federal income tax bracket.